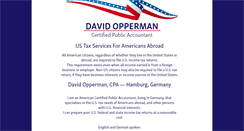

David Opperman, CPA

US Tax Services For Americans Abroad. All American citizens, regardless of whether they live in the United States or abroad, are required to file U.S. income tax returns. This requirement exists even when all income earned is from a foreign business or employer. Non-US citizens may also be required to file a U.S. tax return, if they have business interests or income sources in the United States. David Opperman, CPA Hamburg, Germany. With U.S. financial interests. English and German spoken.

OVERVIEW

This web site davidoppermancpa.de presently has an average traffic classification of zero (the lower the more traffic). We have sifted zero pages inside the web page davidoppermancpa.de and found two websites linking to davidoppermancpa.de.

Links to this site

2DAVIDOPPERMANCPA.DE RANKINGS

This web site davidoppermancpa.de is seeing variant levels of traffic through the year.

Date Range

1 week

1 month

3 months

This Year

Last Year

All time

Date Range

All time

This Year

Last Year

Date Range

All time

This Year

Last Year

Last Month

LINKS TO WEB PAGE

WHAT DOES DAVIDOPPERMANCPA.DE LOOK LIKE?

DAVIDOPPERMANCPA.DE HOST

Our web crawlers caught that a single root page on davidoppermancpa.de took four hundred and thirty-two milliseconds to come up. I could not detect a SSL certificate, so we consider this site not secure.

Load time

0.432 seconds

SSL

NOT SECURE

Internet Address

217.160.122.212

FAVORITE ICON

SERVER OPERATING SYSTEM AND ENCODING

I revealed that davidoppermancpa.de is utilizing the Apache operating system.TITLE

David Opperman, CPADESCRIPTION

US Tax Services For Americans Abroad. All American citizens, regardless of whether they live in the United States or abroad, are required to file U.S. income tax returns. This requirement exists even when all income earned is from a foreign business or employer. Non-US citizens may also be required to file a U.S. tax return, if they have business interests or income sources in the United States. David Opperman, CPA Hamburg, Germany. With U.S. financial interests. English and German spoken.CONTENT

This web site has the following in the web page, "US Tax Services For Americans Abroad." Our analyzers noticed that the web page also stated " All American citizens, regardless of whether they live in the United States or abroad, are required to file U." The Website also said " This requirement exists even when all income earned is from a foreign business or employer. Non-US citizens may also be required to file a U. tax return, if they have business interests or income sources in the United States. David Opperman, CPA Hamburg, Germany."VIEW SIMILAR WEB PAGES

David Oppetit

Tous les médias sont sous license Creative Commons.

David O. Prevatt, Ph.D., PE

Associate Professor, Department of Civil and Coastal Engineering, University of Florida. Prevatt, an associate professor in the department of civil and coastal engineering, at the University of Florida. To document damage to residential buildings following the tornado that devastated Tuscaloosa, Ala. , on 27 April 2011. To honor scientists and engineers from the Republic of Trinidad and Tobago. Prevatt was recognized for his consistent research.

David Oquendo and

Tell the world about us. FalknerPress Theme DESIGNED by DREAMLINESTUDIO Templates. In collaboration with Online Slots.